Betty is 61, her husband Bob is 62. They are looking forward to retirement and have big plans. They would like to get as much out of their retirement, and their savings, as possible. Their financial advisor used a ‘cookie cutter’ approach to retirement planning and suggested they use “conventional wisdom” as the way to go.

$120,000 annually after taxes

This is when taxable accounts are used first, then tax-deferred accounts, followed by tax-free accounts. He also suggested that they start Social Security as soon as possible to minimize pressure on the couple’s portfolio. Good thing Betty and Bob came to Baobab Wealth to get a second opinion on their retirement plan, as our comprehensive analysis showed otherwise.

Betty & Bob worked with us to analyze various portfolio withdrawal strategies to determine which one can add the most value to their portfolio.

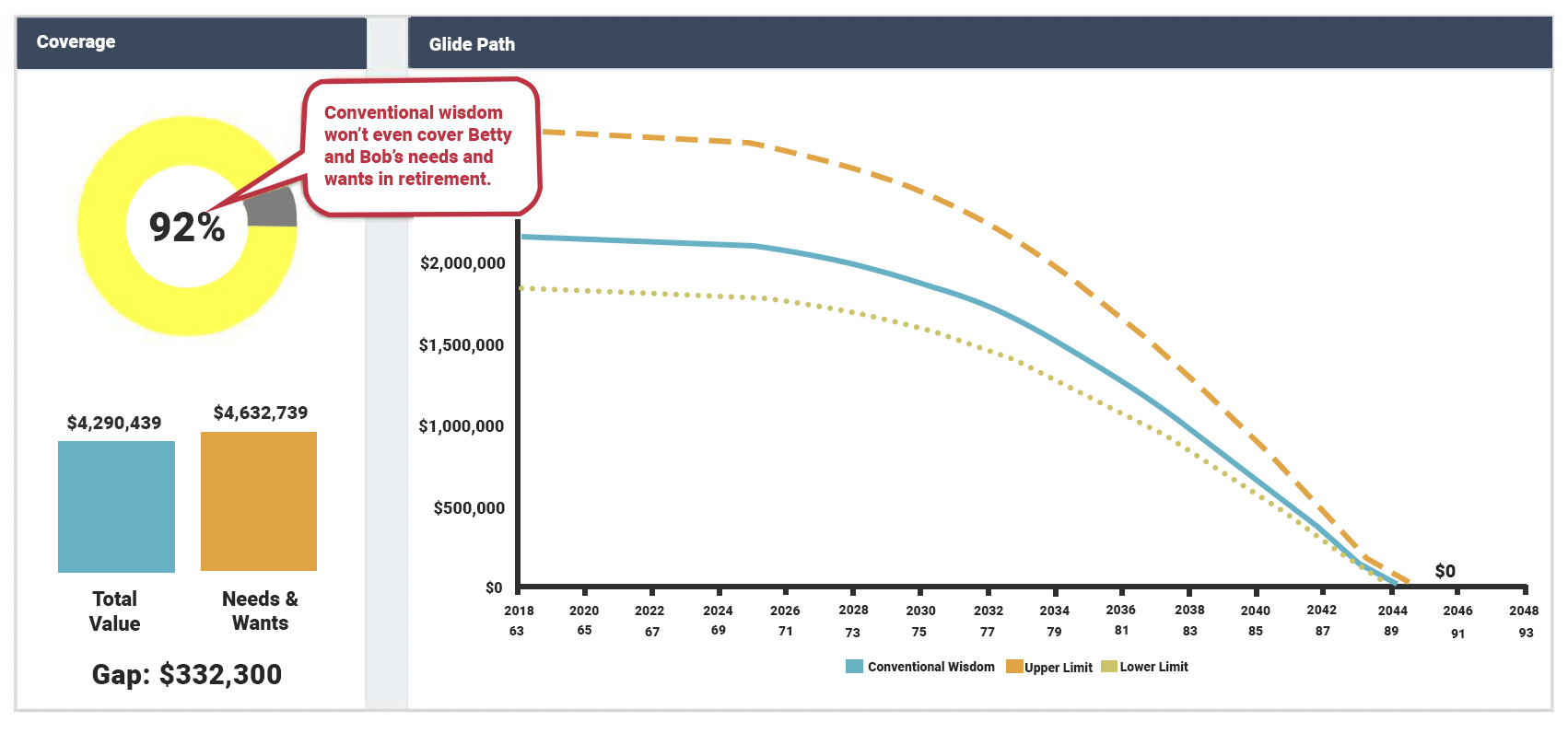

They learned that spending their retirement assets in the typical “conventional wisdom” order – spending all of the taxable, then tax-deferred, and then tax-exempt accounts – won’t actually meet all of their income needs in retirement! There was a large income shortfall and their portfolio would run out of money before Betty would expect to pass away.

They learned that spending their retirement assets in the typical “conventional wisdom” order – spending all of the taxable, then tax-deferred, and then tax-exempt accounts – won’t actually meet all of their income needs in retirement! There was a large income shortfall and their portfolio would run out of money before Betty would expect to pass away.

Betty and Bob notice in our meeting a strategy called ‘Opposite of Conventional Wisdom’, which means spending down their savings in the exact opposite order from Conventional Wisdom: First tax-exempt, then tax-deferred, and then taxable. Guess what? Opposite of conventional wisdom meant more money for Bob & Betty and would provide for Betty throughout her lifetime as well.

Just to be sure there were no better strategies, we analyzed several other potential strategies.

Just to be sure there were no better strategies, we analyzed several other potential strategies.

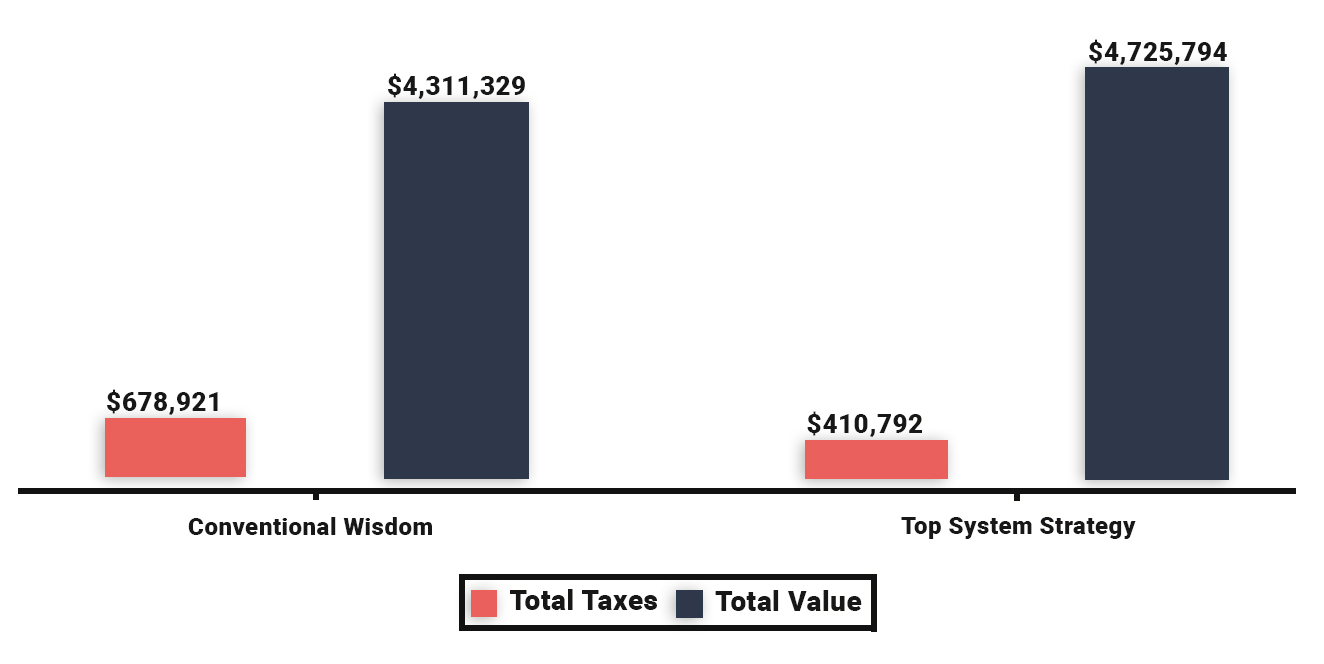

Betty and Bob were surprised to see that there were many strategies that were better than conventional and opposite conventional wisdom! The best strategy actually provided for an additional $414,465 for the couple over the conventional wisdom strategy recommended to them by their original advisor. This was accomplished by managing taxes and coordinating their Social Security claiming strategy.

The recommended top withdrawal strategy prescribed taking advantage of partial Roth conversions each year to minimize the total taxes owed over their retirement horizon. This also allowed them to reduce their Required Minimum Distributions (RMDs) and ultimately save on Social Security taxes as well. As you can see by the graph above, the difference in taxes with the top strategy over conventional wisdom is $268,129 by using partial Roth conversions strategically.

Saving the most on taxes and maximizing their retirement income was great, but it was also important to Bob that he didn’t leave his wife, Betty, with the widow’s penalty one day. This is when one spouse passes leaving the surviving spouse all of the inherited assets and larger social security check, but with half the standard deduction and single tax filing brackets. This can cause a lot of undue financial hardship on the surviving spouse. Great thing this was taken into account with their new retirement plan and we were able to eliminate the widow’s penalty altogether for them!

For Betty and Bob, conventional wisdom would have clearly cost them a lot of money and retirement income! There were multiple strategies that would likely garner far more for them, and their original advisor probably had no idea he was giving them inferior advice. Every scenario is different and has numerous variables that can alter the best strategy for your portfolio withdrawals. By working with us, we find you more money by helping you manage all of the important details that matter to your retirement income.

Traditional “rules of thumb” and “conventional wisdom” used by almost every large financial services company and by advisors, are usually wrong!

Let us show you how maximizing your social security strategy plus smart income management and a tax-efficient withdrawal sequence can potentially add more longevity to your portfolio in retirement.

The first step is to schedule an introductory call to see if our expertise is a good match for your needs.

Baobab Wealth Management

Mobile: (907) 317-8454

Fax: 206-420-5370

Alaska

450 E. Tudor Road

Suite 201

Anchorage, AK 99503

Although it would be great to help everyone achieve financial independence, the truth is, like everyone, we have limited time and capacity. Thus, we like to focus our work on those we can serve best with our expertise.

First, we are only looking to work with those seeking a long-term, trusted relationship with a fiduciary financial advisor and have specific goals and ideas for their future. We enjoy working with those who strive to be and do better than average.

Our most valuable work is done for those in the retirement ‘Red Zone’, where getting it right is crucial to long-term financial success. This is the 10 years leading up to your retirement (financial independence) date as well as the first 5 years of retirement.

We are comprehensive financial planners, but specialize in tax-efficient retirement income planning. If you want to understand the best way to create a safe, increasing and predictable income you can’t outlive, we are the right firm for you. We best serve savers who have accumulated between $250K and $3M of investable assets.

If you also want to pay the IRS the least amount of tax and achieve (or be as close as possible to) the 0% tax bracket (yes, this is absolutely possible) in retirement, we are probably the right firm to work with. We wrote the book on this subject and you can learn more at www.Divorce-The-IRS.com.

You don’t want the cookie cutter advice you have realized is offered at most financial planning firms these days and would prefer a personalized plan that reflects your specific dreams and goals. You would like to see choices in how your retirement income could be structured and not just offered one solution or product. You tend to be more optimistic than pessimistic.

If this sounds like you, and your situation, we invite you to schedule a friendly introductory meeting with us to learn more and explore the possibility of a partnership.

If you would like to request a physical copy of the Divorce the IRS Retirement Kit, please fill out the form below. Want to save the trees? Consider scrolling through all of the same resources on this page instead.

To project the salary of a 30-year old woman currently earning $85,000, we used a women-specific salary curve from Morningstar Investment Management LLC, a registered investment adviser and subsidiary of Morningstar, Inc., which includes the impact of inflation. We added up her projected salary each year over her 40-year career.

We projected the salary of a 30-year old woman currently earning $85,000 and one earning $110,500 (assuming a 30% raise) using a women-specific salary curve from Morningstar Investment Management LLC, a registered investment adviser and subsidiary of Morningstar, Inc. We sum up both projected salaries over 40 years, in today’s dollars, and calculate the difference.

The banking account results assume a 1% long-term average annual cash return over 40 years.

The low end of the range assumes that you invest 20% of your salary ($85,000 currently) with a financial advisor in a diversified mutual fund portfolio comprised of 60% equity and 40% bonds, which is rebalanced to this allocation each year. Fees include average mutual fund fees and an assumed advisory management fee of 1%. The high end of the range assumes that 20% of your salary is invested with Baobab Wealth in a diversified low-cost ETF portfolio comprised of 91% equity to start and growing more conservative towards the end of the investment horizon (40 years). Fees include those for the recommended ETFs and Baobab Wealth’s fee of 0.50%.

We assume salary growth based upon a women-specific salary curve provided by Morningstar Investment Management LLC, and that you save 20% of your salary each year. These results are determined using a Monte Carlo simulation—a forward-looking, computer-based calculation in which we run portfolios and savings rates through hundreds of different economic scenarios to determine a range of possible outcomes. The results for the low end of the range reflects a 70% likelihood of achieving the amount shown or better, and the high end of the range reflects a 50% likelihood of achieving the amounts shown or better. All results include the impact of inflation, and estimated taxes paid on dividends, interest, and realized capital gains.

The results presented are hypothetical, and do not reflect actual investment results, the performance of any Baobab Wealth product, or any account of any Baobab Wealth client, which may vary materially from the results portrayed for various reasons.

Flip the pages with your mouse.

Please fill out the details below and we will get back to you as soon as possible.

Please fill out the form below to get started.

"*" indicates required fields

*We respect your privacy and will never give your information to any third party.

Please fill out the form below to receive access to the ultimate guide for navigating the complexities of living abroad.

"*" indicates required fields

*We respect your privacy and will never give your information to any third party.

View and download resources from the Divorce the IRS Retirement Kit and learn how to set yourself on a path to a tax-free retirement.

"*" indicates required fields

Privacy policy: we hate SPAM and promise to keep your email address safe

Please fill out the form below to receive the first chapter of Divorce the IRS: How to Defuse Your Biggest Tax Time Bombs Before You Retire in your email.

"*" indicates required fields

*We respect your privacy and will never give your information to any third party.